The Freelancers Tax Write Off Solution

If you’re a contract or freelance worker, then you likely know how important it is to claim tax deductible expenses on your taxes..

Maximizing deductions can literally put thousands of dollars back in your pocket, but trying to keep track of all of these expenses yourself requires immense amounts of time and book keeping. Now, there’s a new startup on the scene that’s changing the game.

Keeper Tax

Keeper Tax is a 1099 tax write off tracking software powered by machine learning technology. The founders are Paul & David, who have years of experience in revolutionizing businesses through technology. Keeper Tax sets out to do one main thing- track all expenses in a freelancers transaction history and build a running list of possible write offs. Every gas charge for driving to a meeting, office supply expense, even your monthly rent (if your home doubles as an office space for your work) can be collected by Keeper Tax and used to maximize your tax returns.

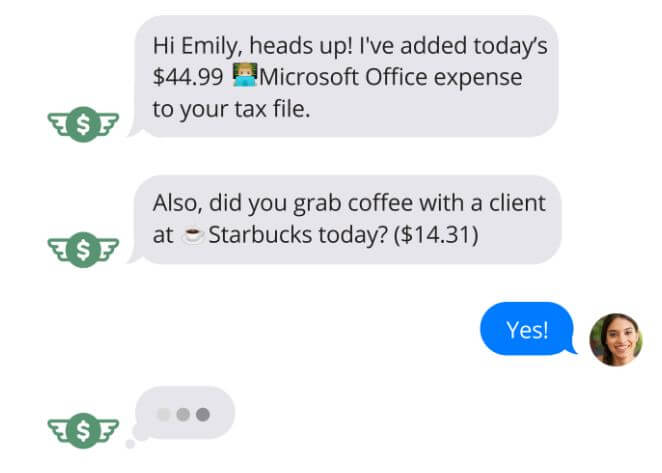

What makes this platform even more revolutionary is its ease of use- Keeper Tax will automatically text your phone number whenever it detects a possible write off. To add that transaction to your write off list (or not), you need only to reply to the text with a “Yes” or “No” and Keeper Tax takes care of the rest.

Keeper Tax costs $10/month, which is nill compared to the savings you could be getting at tax time. For freelancers and other 1099 contract workers, Keeper Tax might be the only “accountant” you need to work with, so forget about hiring third party financial experts. In keeping up with the times, Keeper Tax knows the variety of freelance workers that are out there, and they share lists of the most common write offs on their website, for freelancers like:

- Online Sellers

- Lyft/Uber Drivers

- Models

- Writers

- Social Media Influencers

- Plus many more!

You can see the full list of clientele on the Keeper Tax blog. Of course, any 1099 contract worker can benefit from Keeper Tax.

Keeper Tax uses Plaid to securely receive transaction history from your bank account, which is how they track your write offs. They also offer a helpful FAQ section to answer most questions. If you need more specific assistance, you can text their automated phone number (the one that sends you write off requests) and get in touch with a real person.

I’ve personally started using Keeper Tax and have already seen its benefits and ease of use. Now I’m excited to see how big my savings are come tax season 2020! You can learn more about Keeper Tax and sign up on their website.

If you found this mod helpful, please consider sharing using the social media icons below. Any questions or comments, please let me know on Twitter!