5 Steps to Buying Shares in Real Estate

As an alternative asset, real estate earns substantial returns in the short and long term..

Purchasing an investment property is a profitable way to make money. Investors in this sector profit from owning rental properties, taking mortgages, and investing in partnerships. If you don't have that kind of money to build a property empire, you can own a stake in real estate by buying shares. With as little as $5, you can grow your asset portfolio by earning a passive income in this business. But how do you do that? Here are some steps you can follow.

Steps to Buying Shares in Real Estate

1. Identify the Location and Type of Property

There are four categories of real estate: commercial, residential, industrial, and land. Depending on the type of property investment you would like to get into, you need to select a suitable location. These different categories of real estate serve different purposes, which will inevitably influence the returns you get. Locations have a wide array of prices, and therefore, it's a good idea to carry out extensive market research. Start with your local neighborhood before exploring other areas for real estate prices. Some of the factors to consider in a location are population growth, economic situation, safety, accessibility, public amenities, and transportation.

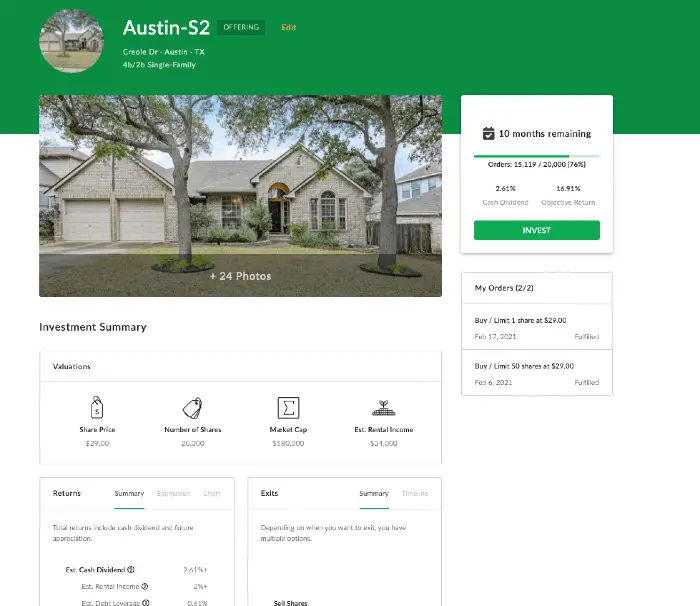

A locale with a growing population could signify a potential real estate opportunity. Picking an area with little or no amenities on the other hand, could result in massive income losses. Before buying any property shares, you can compare the rate per share on Ark7. Houses in the Seattle area for example, could have a higher rate than those in Austin.

The current offerings you'll find will give you an idea of which locations could be better to invest in before making any financial decisions. If you’re curious about the nitty gritty aspects of property research, the experts at Ark7 (mentioned above) have a large amount of research (and can do more) to vet your property of interest.

2. Understand the Property Share Value and Benefits

Investing blindly could cost you a lot of money. To earn a profit in real estate, you need to have a complete understanding of all the potential pitfalls and the best investment strategies to use. Once you choose to buy shares, you have to know how it works to be a smart investment. Just like the stock market, the property market fluctuates sometimes. However, with real estate, the market volatility is typically lower. Before you purchase any shares, be sure to research the market rates, costs per share, the expected dividend, and total returns.

Platforms like Ark7 allow you to access financial data of all the properties available to help you make a decision. For instance, for this Austin S3 property, you can buy shares at $5.4 per share and earn a dividend of 2.61% (as an estimate). These values will differ in another home in a similar or different location. With just $5, you can own property. The Ark7 team also indicates your expected returns over several years. Therefore, it's essential to do your due diligence before putting money down for property shares.

3. Have Financing Options

Real estate investment can be costly. If you are going to buy property shares, plan your finances in advance. Depending on the location you choose, make sure you have enough money to cover the purchase costs. Also, keep in mind that while some of these real estate shares may take time before you can earn returns, users of the Ark7 platform are able to see their monthly dividends right after they invest. Therefore, don't use all your savings or cash needed for financial emergencies. Before investing, it's best to make sound financial decisions.

4. Sign up with a Property Shares Company

Navigating through the purchase process of property shares can be a daunting task, especially if it’s your first time. To make this easier, you can approach a platform like Ark7 to guide you through the process. They don’t give you investment advice, but they do educate you on how to effectively use their tool, so you can make smarter decisions! Buying shares through their platform is pretty straightforward- you simply register your account on their website, choose a property and purchase the shares you would like. Once you register, all the property information is disclosed on the website. You can screenshot the legal documents, photos, videos, and income.

The Ark7 team can be contacted for support, to help in completing your investment profile and guiding through the vetted properties to make the best investment decision. They also manage your property and collect rent. Basically you don't have to worry about the property; they have it all handled.

5. Earn your Property Income

Once you purchase the shares, you will start earning dividends which are deposited in your designated bank account. You can hold the shares for a decade or more, depending on your investment plan. With this, you can benefit from the appreciation value. If you need to sell the shares after a period of time, be sure to set your price according to the market value and maximize your profits. Also, providing the necessary K-1 tax forms for your tax return filings!

Benefits of Buying Real Estate Shares

1. Earn Passive Income

Purchasing shares allows you to earn a passive income each month. You will receive dividends from your investments which is a plus to rental income.

2. Low Market Volatility

Compared to the stock market, real estate is rarely affected by market fluctuations. The value is high and is not as affected by public demand (look at what happened with $doge.

3. No Hidden Costs

When you buy property shares with a reputable company, you can access all the investment information and financial data you need. These teams should provide you with the market rates and expected returns to guide you in making a decision.

How Many Dividends Can You Earn with Real Estate Shares?

Property shares will almost always earn dividends for the investor. The percentage however, varies depending on the property value and location. With Ark7, you get a calculation of your dividends based on the operating expenses and rental income. Some of the expenses include home insurance, repair, and maintenance costs, and property taxes. When the property is vacant or undergoing repairs or an upgrade, the company you work with should deduct the dividends from the next month's income.

Take Away

Real estate investments can be very profitable. When buying property shares, the returns may be short-term or long-term, depending on your strategy. Selecting the wrong property and location could result in a financial loss on your part. Whether this is your first time or a repeat purchase in real estate shares, it's best to work with an investment tool such as Ark7 to automate and oversee much of the tedious process. If you enjoyed this Mod, you might like to read more about these tech tools used by digital nomads! Please share this Mod using the social links below.